- This event has passed.

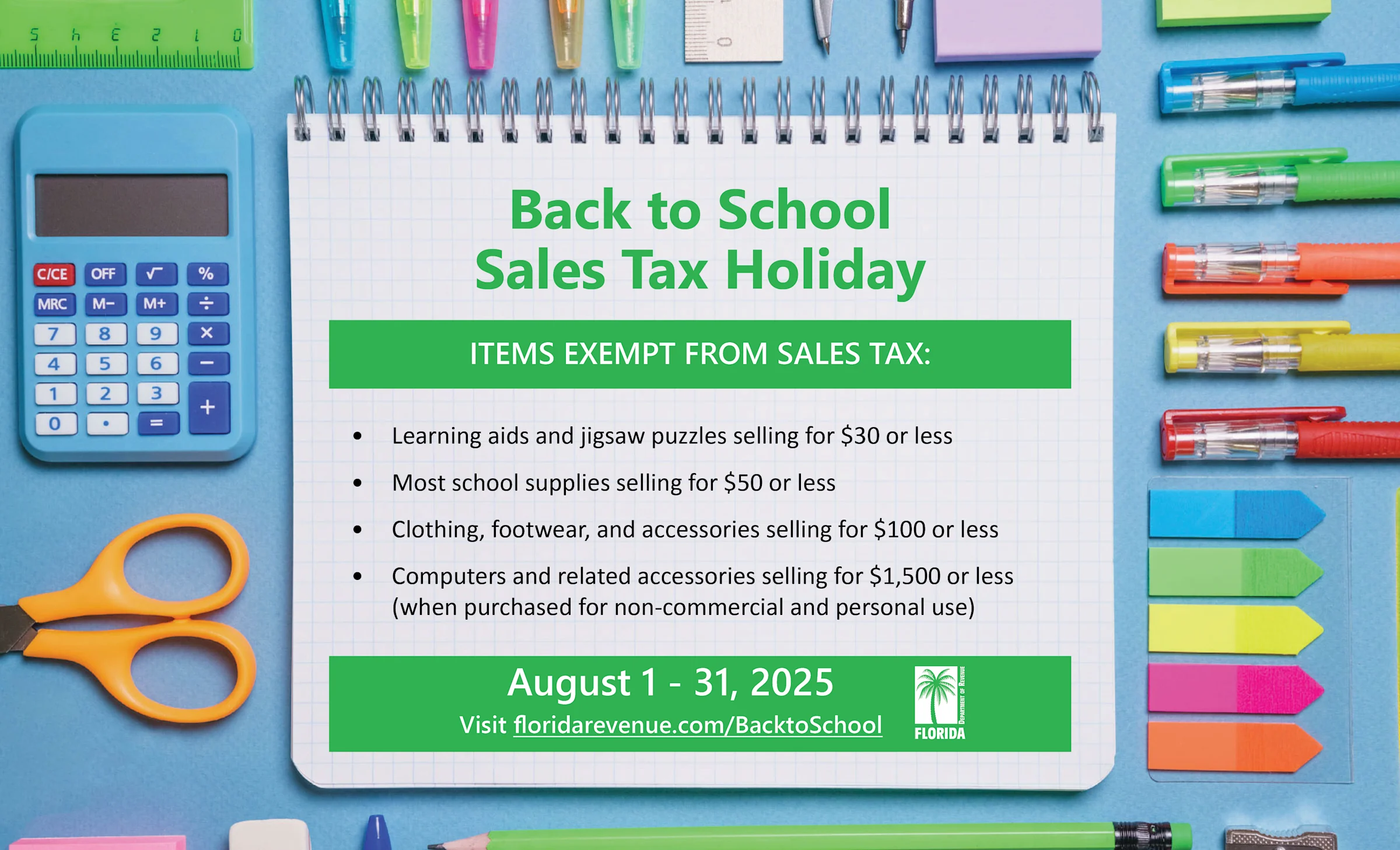

Annual Back-to-School Sales Tax Holiday

The holiday now occurs annually, every August.

During the annual sales tax holiday period, tax is not due on the retail sale of: • Clothing, footwear, wallets, bags, handbags, backpacks, fanny packs, and diaper bags with a sales price of $100 or less per item • Certain school supplies with a sales price of $50 or less per item • Learning aids and jigsaw puzzles with a sales price of $30 or less • Personal computers and certain computer-related accessories with a sales price of $1,500 or less, when purchased for noncommercial home or personal use

The annual sales tax holiday does not apply to: • Briefcases, suitcases, or garment bags • Watches, watchbands, jewelry, umbrellas, and handkerchiefs • Skis, swim fins, roller blades, and skates • Clothing items with a sales price of more than $100 • Any school supply item with a sales price of more than $50 • Books that are not otherwise exempt • Computers and computer-related accessories with a sales price of more than $1,500 • Cellular telephones, video game consoles, digital media receivers, or devices that are not primarily designed to process data • Computers and computer-related accessories purchased for commercial purposes • Rentals of any eligible items • Repairs or alterations of any eligible items • Sales of any eligible items within a theme park or entertainment complex, public lodging establishment, or airport Reference:

Section 45, Chapter 2025-208, Laws of Florida; Emergency Rule 12AER25-1, Florida Administrative Code